Written By:

Danielle Andre

Senior Healthcare Consultant

dandre@bys-hfc.com

Healthcare ABL lenders have historically been hesitant to lend to Home Health Agencies (“HHA”), particularly ones that have a high percentage of Medicare patients. This is due to the episodic nature of Medicare Home Health claims which previously included upfront payments resulting in unearned revenue and potential offsets to A/R. These factors limited the value of the A/R and made valuing Home Health receivables difficult, resulting in a fear of lending to HHAs. In light of the continued shift towards home-based care and changes to HHA reimbursement that eliminates the upfront payments and some of the risk to lending to HHA’s, now may be the opportune time for some lenders to get involved in lending to HHAs.

There continues to be significant evidence of an increasing shift towards home-based care, including:

- Factors driving the hospital-level care to the home include the success of the Acute Hospital Care at Home model, the shortage of clinicians, the overall impact of COVID-19, and the growing desire of patients to stay home. The Front & Sullivan Apr21 article stated changing reimbursement policies and the healthcare provider shortage will strongly drive the home health care market, creating growth opportunities.

- McKnight Senior Living surmised in its Apr21 article that not only is home healthcare more effective at improving outcomes, but is also a cost-effective alternative, saving both Medicare and taxpayers’ money. In the study they conducted, the average cost was $13,012 for home healthcare vs. $20,325 for inpatient hospitalization.

- In McKnight’s Dec21 Long-Term Care News survey of 317 nursing home owners, administrators and top nurse managers, 57% of respondents indicated they are less optimistic about the industry’s prospects. This is evidenced by the NIC MAP Data Service skilled nursing report released 12/30/21 that showed occupancy rates are still far from pre-pandemic levels.

- JAMDA’s Sep21 report states patients discharged from the hospital to home or to inpatient rehabilitation have been fairly consistent during the pandemic, whereas the percentage discharged to nursing facilities declined from 19% of hospital discharges in 2019 to 14% by Oct20.

- In Oct21, bipartisan legislation introduced the “Choose Home Recovery Act of 2021” (H.R. 5514) in the House of Representatives. The bill proposes home health agencies to provide Medicare recipients up to 30 consecutive days, to a maximum of 100 days for a specific illness, of in-home nursing care.

- The Department of Veterans Affairs’ (VA) stated in its 01/24/22 article that it is expanding its Home-Based care programs in response to recent projections estimating the number of veterans eligible to receive nursing home care will grow from 2MM in 2019 to upwards of 4MM by 2039.

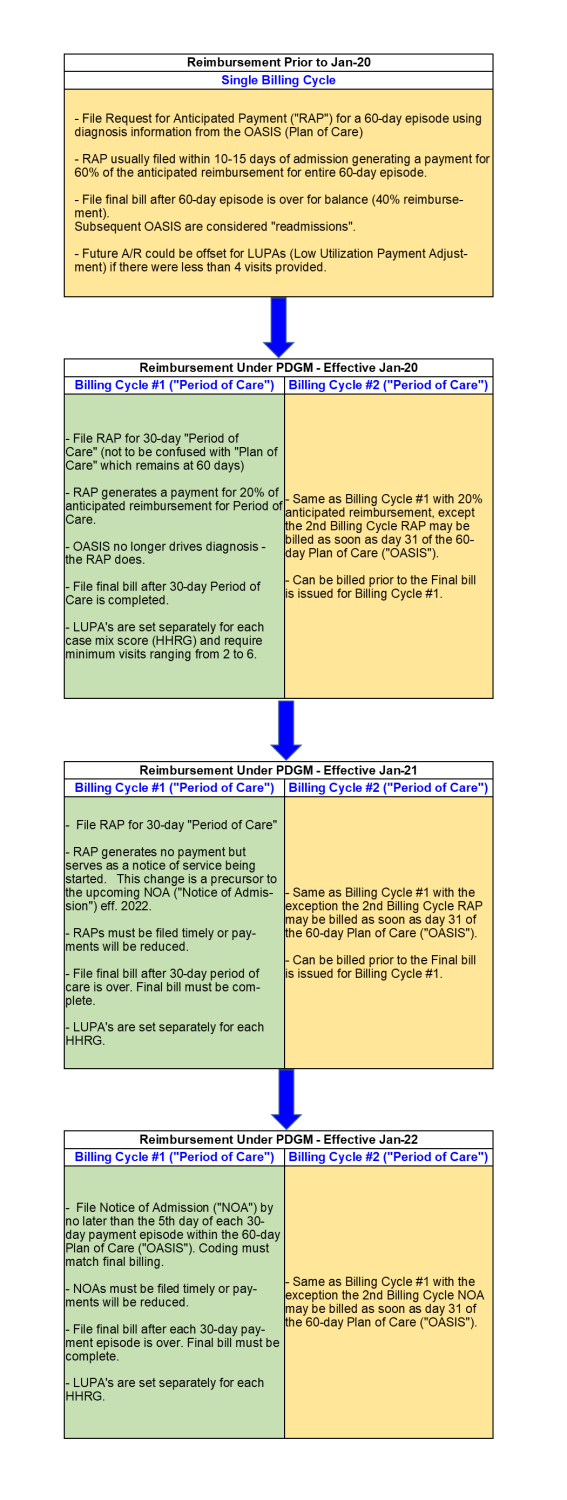

Medicare reimbursement for HHAs has also experienced significant changes in the last few years. The Patient-Driven Groupings Model (“PDGM”) was a sweeping change that went into effect January 1, 2020, that shifted home health reimbursement away from a volume-driven model to a model that focuses more on the unique needs and goals of each patient. Reimbursement under PDGM was modified again on January 1, 2021, resulting in no upfront payments being made to HHAs changing Medicare reimbursement from a model that effectively paid 60% of a single 60-day episode up front to one that pays for two 30-day episodes in arrears. There have been additional updates for 2022, including:

Timeliness of filing Notice of Admission (“NOA”) – Effective Jan22, the NOA must still be filed by the 5th day from the start of each billing period. In the event a NOA is filed late, a 3% per day penalty back to day #1 is assessed resulting in a ~20% penalty.

- Proper Coding of NOAs – Medicare requires that the primary diagnosis and HIPPS codes used on the NOA must match what is included in the Final claim filing. Therefore, “generic” codes may not be used requiring HHA’s to have accurate documentation on the front end, which has been a long-standing struggle.

- 2% Sequestration Returns – The 2% Medicare Sequestration paused by CMS due to the COVID-19 pandemic will be phased back in during the 2022 calendar year. Effective April 2022, a 1% payment reduction will be implemented. An additional 1%, for a total of 2%, will be implemented effective July 2022.

- CMS decided to maintain the 4.36% payment rate adjustment under the PDGM for a third straight year to account for a “behavioral adjustment” but did acknowledge that this needed further evaluation.

For more information on the changes to the Medicare Home Health reimbursement structure over the last several years please see Exhibit “A” at the end of this article.

While these changes have been significant, they provide an opportunity for ABL lenders as slowing reimbursement for home health providers results in increased “eligible” A/R to potentially lend on. While there may continue to be more A/R, which is an opportunity for lenders, it is as important as ever to complete adequate due diligence to understand the collectible amount of the A/R. Specific areas that should be reviewed include:

- A/R Performance – Ample remittance advice, rollforward, and static pool testing are critical to assessing the collectability of a borrower or prospective borrower’s A/R.

- Operational Processes – A review should include gaining a comfort level with both the timeliness of filing NOAs and the proper coding of NOAs as HHA’s with poor processes in these areas will be penalized.

- Revenue Recognition – While HHAs have an opportunity (with the changes implemented by CMS in 2022) to discontinue their previous booking of deferred revenue with the filing of the NOA, this has not been the case in the experience of Home Health examinations conducted by BY&S to date as many HHA’s continue to book the deferred revenue. This is not an issue for a lender if it is identified and accounted for in the borrowing base.

- Low Utilization Payment Adjustment (“LUPA”) – HHAs still have cases where minimum visit requirements are not met which will result in takebacks, or LUPAs. However, the potential of LUPA offsets against A/R can be incorporated into the borrowing base as the amount of potential LUPAs can typically be estimated by looking at historical A/R performance and LUPA activity.

In conclusion, BY&S feels that entering the home health lending space is still a viable option for many lenders. However, it is more important than ever for Lenders to take the time to understand the revenue cycle of the industry, value the A/R correctly, and monitor their borrower’s performance. Through this, Lenders should be in a good position to capitalize on the changes that have occurred.