Written By:

Danielle Andre

Senior Healthcare Consultant

dandre@bys-hfc.com

Healthcare ABL lenders have historically been hesitant to lend to Home Health Agencies (“HHA”), particularly ones that have a high percentage of Medicare patients. This is due to the episodic nature of Medicare Home Health claims which included upfront payments resulting in significant unearned revenue and potential offsets to A/R. These factors limited the value of the A/R and made valuing Home Health receivables difficult, resulting in a fear of lending to HHAs. In light of the increased healthcare services that have been provided at home during COVID-19, and a movement to further shift services towards home-based care, coupled with changes to HHA reimbursement that reduces the upfront payments and some of the risk to lending to HHA’s, now may be the opportune time for some lenders to get involved in lending to HHAs.

There is considerable evidence that there will be a continued shift towards home-based care post COVID, including:

- The Centers for Medicare and Medicaid’s (“CMS”) acute hospital care at home model appears to be gaining traction in Congress and among special interest groups. As of 04/16/21, there are 56 health systems and 127 hospitals in 29 states with this waiver.

- Factors driving the hospital-level care to the home include the success of the acute hospital care at home model, the shortage of clinicians, the overall impact of COVID-19, and the growing desire of patients to stay home. The Front & Sullivan Apr21 article stated changing reimbursement policies and the healthcare provider shortage will strongly drive the home health care market, creating growth opportunities.

- In a recent Whitehouse announcement President Biden called on Congress to put $400 billion toward expanding access to quality, affordable home or community-based care for aging relatives and people with disabilities, thereby promoting the “Care at Home” by increasing wages of Direct Care workers.

- Margins for HHA’s are projected to not only maintain but to exceed those 2020 gains as mentioned in the Home Health Care News article dated 03/16/21. In Apr21, McKnight Senior Living surmised in its argument for home care that not only is home healthcare more effective at improving patient outcomes, it is also a cost-effective alternative to hospitalization, saving both Medicare and taxpayers money. In computing total 90-day costs, researchers found average home health costs were significantly lower than inpatient care ($13,012 vs. $20,325, respectively).

- The American Health Care Association and National Center for Assisted Living now estimates the nursing home industry is expected to lose $94 billion over the 2-year period ending 2021. As mentioned in the McKnight Senior Living Feb21 article, national nursing home occupancy dropped 16.5% from 01/31/20’s 85% to 01/31/21’s 68.5% and recognized $11.3 billion in 2020 losses with an anticipated increase in 2021 losses of $22.6 billion.

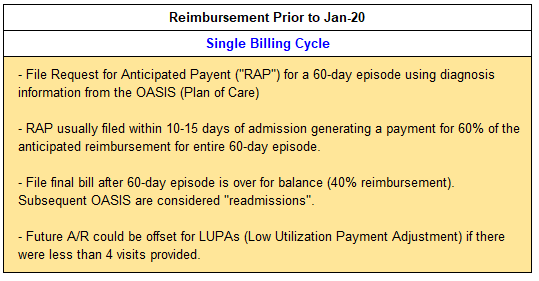

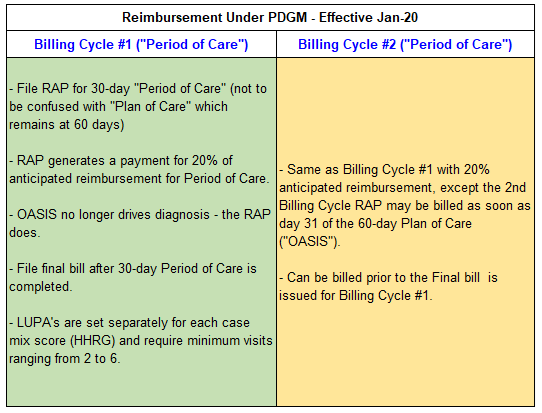

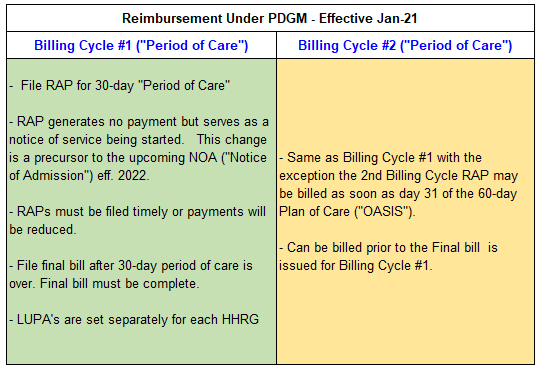

Medicare reimbursement has undergone significant changes in the last few years. The Patient-Driven Groupings Model (“PDGM”) was a sweeping change that went into effect January 1, 2020, that shifted home health reimbursement away from a volume-driven model to a model that focuses more on the unique needs and goals of each patient. Reimbursement under PDGM was modified again on January 1, 2021, resulting in no upfront payments being made to HHAs. The net impact of all these changes is that Medicare reimbursement has migrated from one that effectively paid 60% of a single 60-day episode up front to one that now that pays for two 30-day episodes in arrears. Below is a brief overview of the changes in the reimbursement structure over the past 2 years that have resulted from PDGM:

Although these changes have been significant, they provide an opportunity for ABL lenders as home health providers will not get paid as fast resulting in more “eligible” A/R to potentially lend on. While there may be more A/R, and this is an opportunity for lenders, it is as important as ever to complete adequate due diligence to understand the collectible amount of the A/R. Specific areas that should be reviewed include:

- Timeliness of filing Request for Anticipated Payment (“RAP”) – Although there is no longer the 20% payment with the initial RAP effective Jan21, the RAP must still be filed during the 2021 calendar year (changes to a Notice of Admission (“NOA”) effective Jan22). Included in recent changes is a 5-day RAP filing deadline from the start of each billing period. In the event a RAP is filed late, a 3% per day penalty back to day number one is assessed resulting in a minimum 18% penalty.

- Proper Coding of RAPs – Medicare requires that the primary diagnosis and HIPPS codes used on the RAP must match what is included in the Final claim filing. Therefore, “generic” codes may not be used requiring HHA’s to have accurate documentation on the front end, which has been a long-standing struggle.

- Low Utilization Payment Adjustments (“LUPA”) – HHAs will still have cases where minimum visit requirements are not met which will result in takebacks, or LUPAs. However, the potential of LUPA offsets against A/R can be incorporated into the borrowing base as the amount of potential LUPAs can typically be estimated by looking at historical A/R performance and LUPA activity.

- Collection Rates – While the most recent changes just went into effect in Jan21, there should now be sufficient billing and collection information to evaluate an HHA’s potential A/R performance and estimate collections rates since the recent changes were implemented. Understanding how deferred revenue and unearned A/R are affecting the collateral will continue.

It will be more important than ever that HHA’s have their operational processes updated to meet these new standards. HHA’s with poor processes will tend to not be successful. Ample remittance advice, A/R rollforward, and static pool testing are critical to assessing the collectability of the A/R and an organization’s efficiency of its billing processes.

In conclusion, BY&S feels that entering the home health lending space is a viable option for many lenders as the changes in reimbursement of HHA’s will not only result in an increase in provider’s A/R but will make valuing the A/R easier over time. Lenders that take the time to understand the revenue cycle of the industry, value the A/R correctly, and monitor their borrower’s performance should be in an advantageous position to capitalize on the changes that have occurred.